Best Prop Firms In 2025

We tested dozens of the top prop trading firms to find the best challenges to become a funded trader in 2025. Our firsthand testing focuses on areas like challenges and rules, fees and spreads, profit splits and scaling, market access and leverage, and trading platform options. Here’s our final list of the 10 best prop firms.

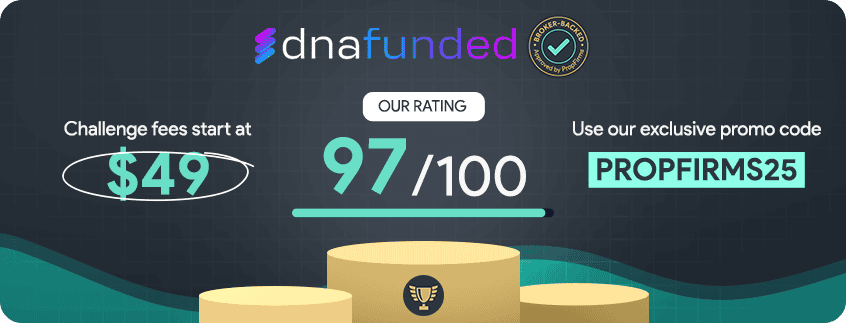

DNA Funded ranked 1st place in our list of the best prop firms, earning a top score of 97/100 for its low challenge fees from $49, flexible one- and two-step evaluations, and 80%–90% profit splits. Backed by DNA Markets, it offers tight spreads and uses the TradeLocker platform.

DNA Funded ranked 1st place in our list of the best prop firms, earning a top score of 97/100 for its low challenge fees from $49, flexible one- and two-step evaluations, and 80%–90% profit splits. Backed by DNA Markets, it offers tight spreads and uses the TradeLocker platform.

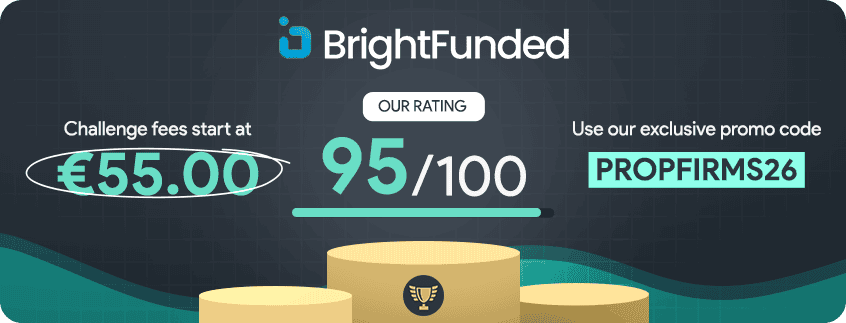

BrightFunded earnt 2nd place with its flexible two-phase challenges, profit splits scaling to 100%, and innovative add-ons for faster payouts. Its Trade2Earn loyalty program rewards active traders with free evaluations, while the firm’s broad market access and unlimited scaling provide long-term growth potential.

BrightFunded earnt 2nd place with its flexible two-phase challenges, profit splits scaling to 100%, and innovative add-ons for faster payouts. Its Trade2Earn loyalty program rewards active traders with free evaluations, while the firm’s broad market access and unlimited scaling provide long-term growth potential.

Additionally, BrightFunded now publishes payout certificates to show what funded traders are actually earning. The example on the right shows a $4,052.71 payout from April 2025. It’s a simple way to back up their fast payouts, scaling model, and growing community with real proof.

Additionally, BrightFunded now publishes payout certificates to show what funded traders are actually earning. The example on the right shows a $4,052.71 payout from April 2025. It’s a simple way to back up their fast payouts, scaling model, and growing community with real proof.

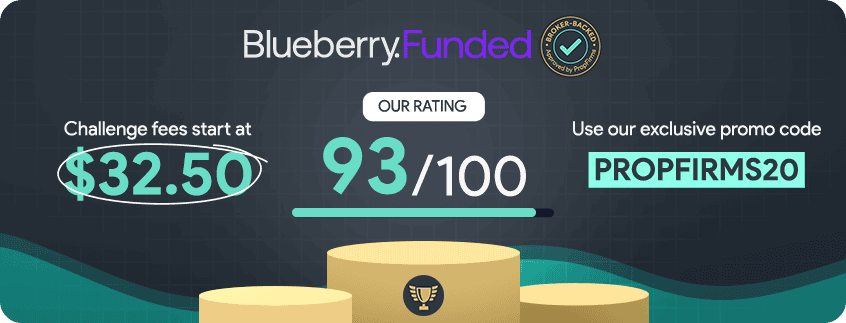

Blueberry Funded ranked 3rd on the list of the best prop trading firms, thanks to its low challenge fees starting at $40, access to over 100 financial markets, and competitive scaling options up to $2 million.

Blueberry Funded ranked 3rd on the list of the best prop trading firms, thanks to its low challenge fees starting at $40, access to over 100 financial markets, and competitive scaling options up to $2 million.

Blueberry Funded has started sharing verified payout snapshots to show exactly what traders are earning. The example on the right shows a $3,758.40 payout issued in May 2025. While still a newer firm, Blueberry is backing its scaling model and low entry costs with real, visible trader results.

Blueberry Funded has started sharing verified payout snapshots to show exactly what traders are earning. The example on the right shows a $3,758.40 payout issued in May 2025. While still a newer firm, Blueberry is backing its scaling model and low entry costs with real, visible trader results.

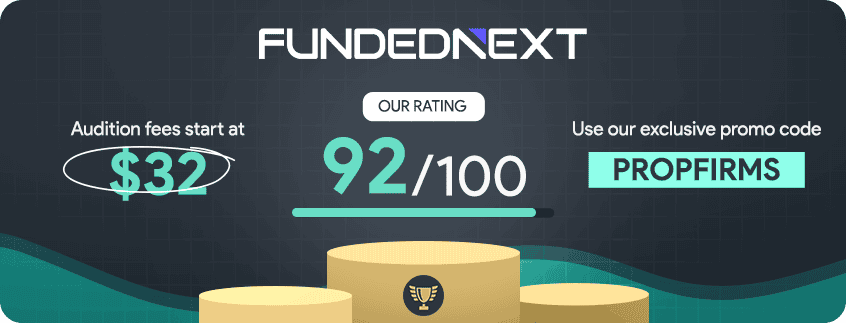

FundedNext came in 4th place, offering funded accounts with profit splits up to 95%, a flexible scaling plan, and fast withdrawals. Use exclusive discount code PROPFIRMS to receive a 120% refund after completing your challenge.

FundedNext came in 4th place, offering funded accounts with profit splits up to 95%, a flexible scaling plan, and fast withdrawals. Use exclusive discount code PROPFIRMS to receive a 120% refund after completing your challenge.

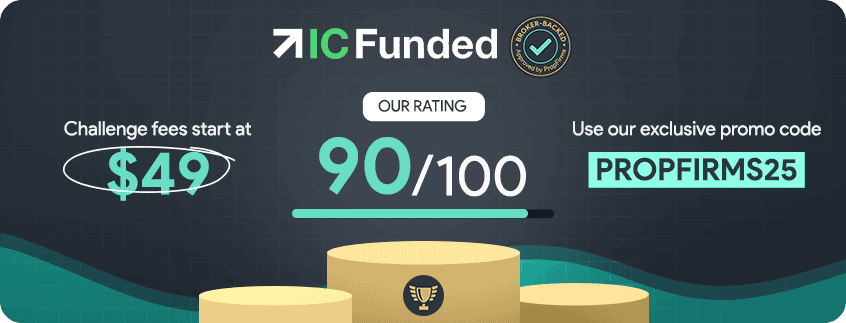

IC Funded is ranked 6th overall in our overall best prop firm list, but takes 1st place on our list of the best forex prop firms. It’s backed by IC Markets and offers ultra-low spreads from 0 pips, competitive fees, and top-tier platforms like MT4, MT5, and cTrader.

IC Funded is ranked 6th overall in our overall best prop firm list, but takes 1st place on our list of the best forex prop firms. It’s backed by IC Markets and offers ultra-low spreads from 0 pips, competitive fees, and top-tier platforms like MT4, MT5, and cTrader.

FXIFY Futures ranks 7th overall in our list of the best prop firms worldwide, and it’s the highest-rated futures prop firm we tested, scoring 88/100.

FXIFY Futures ranks 7th overall in our list of the best prop firms worldwide, and it’s the highest-rated futures prop firm we tested, scoring 88/100.

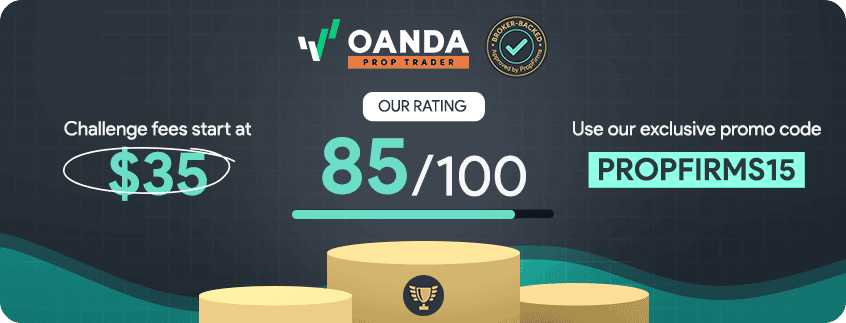

OANDA Prop Trader ranked 8th overall in our firsthand prop firm testing and is one of the best options for beginner traders. It offers low entry fees from $35, profit splits up to 90%, and uses the trusted MT5 platform for trading forex, indices, and commodities.

OANDA Prop Trader ranked 8th overall in our firsthand prop firm testing and is one of the best options for beginner traders. It offers low entry fees from $35, profit splits up to 90%, and uses the trusted MT5 platform for trading forex, indices, and commodities.

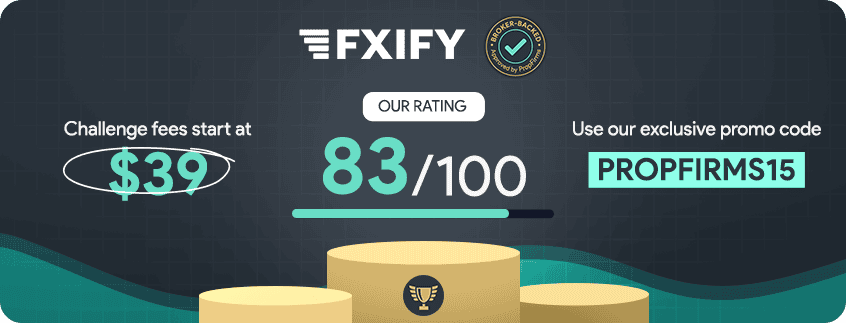

FXIFY ranked 9th overall, but it holds 1st place on our

FXIFY ranked 9th overall, but it holds 1st place on our